40 Under 40 Honoree: How Michael Shaner is Shaping the Future of Business

Michael Shaner, recognized in the Pacific Coast Business Times’ 2025 “40 Under 40” list, exemplifies visionary leadership and client-focused dedication as an Audit Manager at Bartlett, Pringle & Wolf, LLP. His approach combines technical expertise with personal rapport, fostering a culture of growth and innovation that is shaping the future of accounting services. Discover how Shaner is making an impact on the Central Coast’s business landscape.

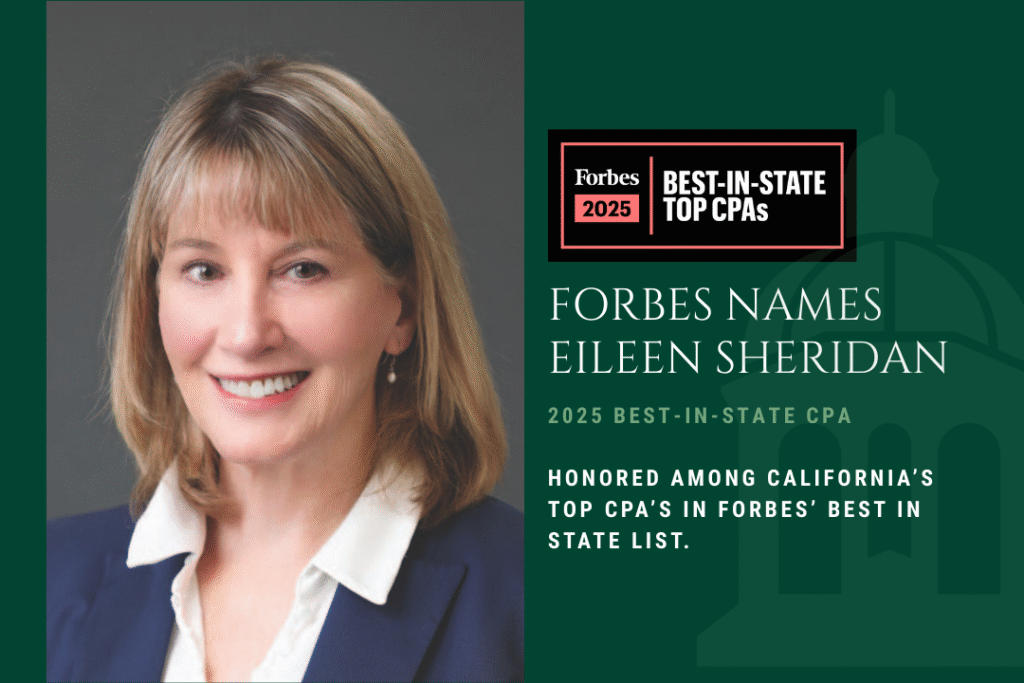

Forbes Names Eileen Sheridan 2025 Best in State CPAs

Bartlett, Pringle & Wolf, LLP proudly announces that Managing Partner Eileen Sheridan has been named to Forbes’ 2025 Best-in-State CPAs list, recognizing her exceptional expertise, innovation, and dedication to client success. Selected through a rigorous national vetting process, Sheridan’s leadership in estate, trust, and charitable tax planning, combined with her commitment to mentorship and community service, reflects the firm’s mission to deliver excellence and drive long-term financial success for clients across Santa Barbara and the Central Coast.

Strategic Tax Planning: How the OBBBA Influences Future Business Decisions

The One Big Beautiful Bill Act (OBBBA) of 2025 marks the largest U.S. tax overhaul since 2017, introducing significant changes for individuals and businesses. Discover how this legislation impacts SALT deductions, R&E expenses, bonus depreciation, and international tax rules, and learn how proactive planning can help you navigate the new tax landscape effectively.