The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

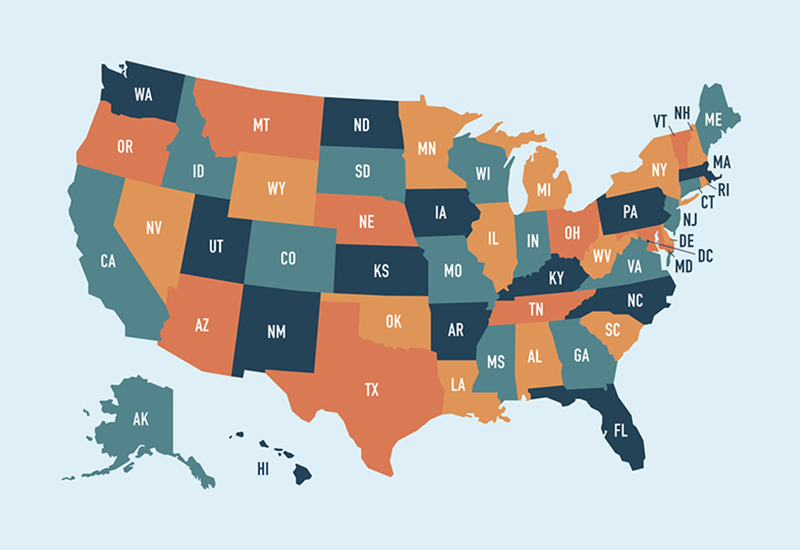

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...New Overtime Rule May Impact Your Business

In 2014, President Obama instructed the Secretary of Labor to update the overtime regulations under the ...

Read this insight Safe Harbor Benefits Restaurant and Retail Industry

There has been a lot of discussion surrounding Tangible Property Regulations—from implementing the new regulations to ...

Read this insight Danna McGrew Named to the Board of Directors for the Scholarship Foundation of Santa Barbara

BPW Partner, Danna McGrew, was recently named to the Scholarship Foundation of Santa Barbara’s Board of ...

Read this insight Bridget Foreman Named One of the Top 50 Women in Business

Congratulations to BPW Partner, Bridget Foreman, who was named one of the Top 50 Women in ...

Read this insight Reporting Requirements When Hiring Independent Contractors

Does your business hire independent contractors? If so, are you filing all that you need to ...

Read this insight California Franchise Tax Board Launches New Version of MyFTB

This January the California Franchise Tax Board (FTB) launched a new and improved version of MyFTB. ...

Read this insight Moving Forward with SSARS 21

December 15, 2015 marked an important date in accounting and review standards history. One of the ...

Read this insight Scott Hadley Named Who’s Who in Business Leadership

The Pacific Coast Business Times named BPW Managing Partner, Scott Hadley, as one of the 2016 ...

Read this insight New Year Brings New Partners & Promotions

With the New Year brings exciting news at BPW. Not only did three team members receive ...

Read this insight The Risks of Debt-Forgiveness Programs

With the ever-rising cost of education, students are forced to take on more and more debt. ...

Read this insight IRS Announces Various Tax Benefit Increases for 2016

For tax year 2016, the IRS recently announced many annual inflation adjustments. IRS Revenue Procedure 2015-53 ...

Read this insight 2015 Tax Extenders Passed

On December 18, the Senate passed — and the President signed into law — the Protecting ...

Read this insight