The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

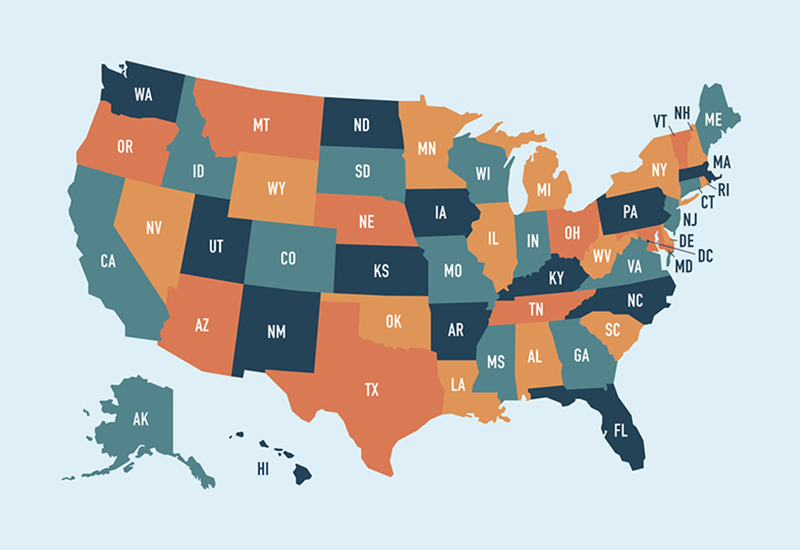

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...California Competes Credit Offers an Incentive to Keep Businesses in the State

Are you looking to start a business in California or considering whether or not to keep your ...

Read this insight Abel Barragan Recognized as CalCPA YEP of the Year

Congratulations to Abel Barragan on being named...twice! Abel was named Young and Emerging Professional by the ...

Read this insight Electric Cars: Good for Your Tax Return!

In the beginning, the only purpose of the United States income tax was to raise revenue ...

Read this insight Santa Barbara Chamber Nominates BPW as Large Business of the Year

BPW is honored to have been nominated as Large Business of the Year by the Santa ...

Read this insight BPW Introduces New Online Bill Pay Service

Please welcome our new online bill pay service—gotoBilling! In our continued efforts to enhance our clients' experience, Bartlett, ...

Read this insight New Year…New Company? The Differences Between LLCs, C Corps and S Corps

As we continue making plans for the New Year, you may be looking at your business with a fresh eye and ...

Read this insight How Nonprofits Can Fight Fraud

Given the recent economic downturn, is it any wonder that fraud is a hot topic in ...

Read this insight IRS Allows $500 Carryover for Unused Healthcare FSAs

The IRS just announced a new exception to the longstanding "use or lose" rule for healthcare ...

Read this insight BPW Helps Spread Holiday Cheer at Junior League’s Festival of Trees

Santa Barbara, CA – BPW sponsored a Christmas tree at the first annual Festival of Trees to support ...

Read this insight Deducting Charity-Related Expenses

Most people are aware of deducting charitable contributions, but did you know that you may also ...

Read this insight The Buzz on Benefit Corporations & B Corps

Ben & Jerry's, Etsy, Seventh Generation and our very own local icon, Patagonia, are a few ...

Read this insight Record Retention Guidelines and Policy Development

Although the topic of recordkeeping, including retention and destruction of records, may appear to be straightforward, ...

Read this insight