Expanded Sec. 152 for Dependents

The Tax Cuts and Jobs Act broadened the Child Tax Credit and introduced some big changes…

Read this Insight...The Impact of Tax Reform on Alimony

The Tax Cuts and Jobs Act has turned the tax code upside down on alimony, especially…

Read this Insight...IRS Releases 2018 Pension Plan Contribution Limits

A new year brings new changes. The Internal Revenue Service recently announced updated pension plan contribution…

Read this Insight...A New Twist on an Old Scam

As many are aware, tax scams are on the uptick. What you may not know is…

Read this Insight...Construction Companies Go Green

The construction industry has discovered that greening its energy sources with renewable energy initiatives is good…

Read this Insight...New Deadline and Increased Penalties for Forms 1099 and W-2

The IRS is getting stricter on filing deadlines for information returns and have increased penalties for…

Read this Insight...IRS Announces Various Tax Benefit Increases for 2016

For tax year 2016, the IRS recently announced many annual inflation adjustments. IRS Revenue Procedure 2015-53…

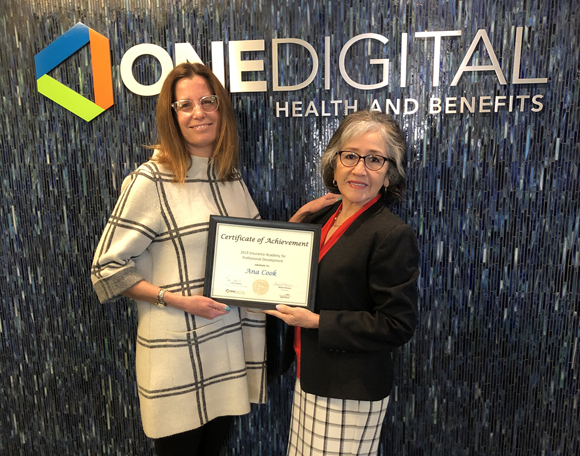

Read this Insight...Team Member Spotlight

Congratulations to Ana Cook for completing the Insurance Academy Series with OneDigital! Ana wears many hats ...

Read this insight How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives ...

Read this insight Year-End Tax Planning for Individuals

As we closed out the 2018 tax filing season, we saw significant changes over the last ...

Read this insight Year-End Tax Planning for Businesses

The first year of filing under the new Tax Cuts and Jobs Act (TCJA) is in ...

Read this insight Crystal Knepler Named One of the 2019 40 Under 40

Congratulations to BPW Tax Manager Crystal Knepler on being named one of the 2019 40 Under ...

Read this insight Required Reporting on Cooperative Commissions in Real Estate Transactions

If you are a real estate broker or agent, you may not be aware of the ...

Read this insight Expanded Sec. 152 for Dependents

The Tax Cuts and Jobs Act broadened the Child Tax Credit and introduced some big changes ...

Read this insight IRS Sends Warning Letter to Cryptocurrency Users About Reporting

Taxpayers who exchange cryptocurrency may receive a letter this month from the IRS regarding reporting issues. ...

Read this insight Team Member Spotlight

Congratulations to our team members on their recent promotions! A total of 13 team members took ...

Read this insight Uncertain Future for CA Estate Tax

California is currently among 30 states that do not impose a state estate tax. State legislature, ...

Read this insight Top 5 Real Estate Accounting Mistakes

Even some of the savviest real estate brokers can get trapped in the most common accounting ...

Read this insight CA, You’re Not Alone – Treasury Bans All SALT Deduction Workarounds

The Treasury Department and the IRS recently issued final regulations blocking all states from trying to ...

Read this insight