The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

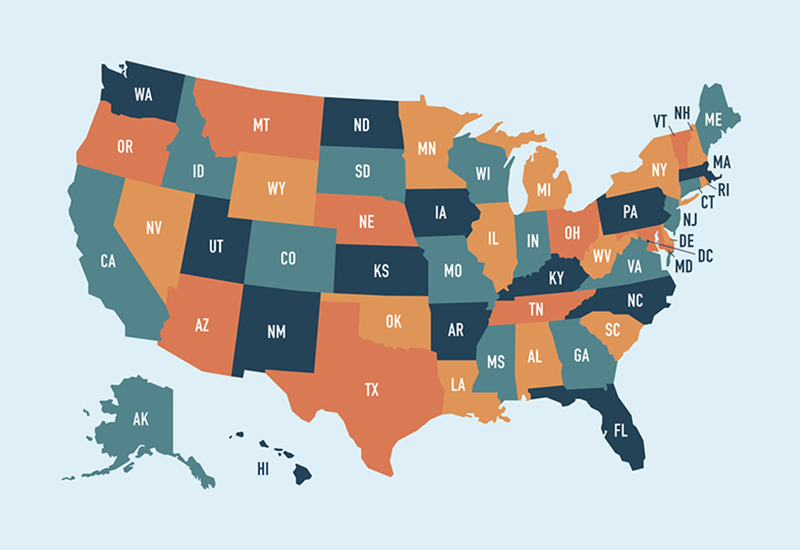

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...Reduced Restrictions on In-Plan Roth Rollovers

Among the changes and extensions in the recently enacted American Taxpayer Relief Act of 2012 ("Act"), ...

Read this insight New Option for Home Office Deductions

In an effort to make things easier for owners of home-based businesses and for some home-based ...

Read this insight 2013 Community Appointments

Santa Barbara, CA – Bartlett, Pringle & Wolf's team members announce their 2013 community appointments on various nonprofit boards. As ...

Read this insight The American Taxpayer Relief Act and How It Affects You

On January 1, 2013, by a vote of 89-8, the Senate passed H.R. 8, the American ...

Read this insight IRS Questioning Under-Reporting on Business Returns and 1099-K Matching

The Internal Revenue Service is now using information statements to look for under-reporting on business returns. ...

Read this insight Proposition 30 Imposes Additional Taxes Retroactively & Increases Sales Tax

On the November 2012 Ballot, 55.3% of Californians voted YES on California Proposition 30. It is ...

Read this insight BPW Named Among 2012 Best Accounting Firms to Work For

Santa Barbara, CA – We are very excited to announce that for the second time Bartlett, ...

Read this insight 2012 Year-End Tax Planning for Individuals and Businesses

As 2012 is coming to a close, now is an ideal time to start preparing for ...

Read this insight Jacob Sheffield Receives 40 Under 40 Award

Santa Barbara, CA – Congratulations to Jacob Sheffield who was recently named one of the 40 ...

Read this insight Three Strategies That Add Flexibility to Your Estate Plan

In recent years, estate planning has been complicated by uncertainty over the future of the federal ...

Read this insight Understanding and Utilizing Financial Statements of Nonprofit Organizations

Financial statements provide a wealth of financial information about a nonprofit organization's most recent month, quarter ...

Read this insight Tax Court Denial of Charitable Deductions

The Tax Court recently ruled that a married couple's significant amount of charitable contributions were not ...

Read this insight