Insights & News

The CARES Act: An Overview for Individuals

The CARES Act provides some big wins for individual taxpayers who are in need of an…

Read more →The CARES Act: An Overview for Businesses

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on Friday, March…

Read more →Income Tax Relief in Response to COVID-19 Outbreak

On March 20, 2020, the IRS extended the federal tax filing deadline to July 15, 2020,…

Read more →Reporting Requirements for Video Game Currency

Amid school and business closures, some gamers may be increasing their screen time and raking in…

Read more →IRS Released Guidance on Meal and Entertainment Expense Deductions

In recently-proposed regulations, the IRS states that, in general, taxpayers can deduct 50% of the ordinary food…

Read more →Is a Donor-Advised Fund Right for You?

Donor-advised funds (DAFs) have grown in popularity over the past decade. According to the National Philanthropic Trust…

Read more →The SECURE Act: Key Takeaways and Strategies to Consider

Over the past few years, we have seen some of the greatest shifts in tax legislation.…

Read more →Tax Tips for Law Firms

Whether you’re a partner or an associate in a law firm, the IRS has rules that…

Read more →Tax Deductions from Land Donations Under Scrutiny

The IRS announced that they will be keeping a watchful eye on certain land donation deals…

Read more →IRS Establishes No Clawback Rule on Gifts and Estates

‘Tis the season for giving! In a recent announcement, the IRS presented the highly-anticipated final regulations…

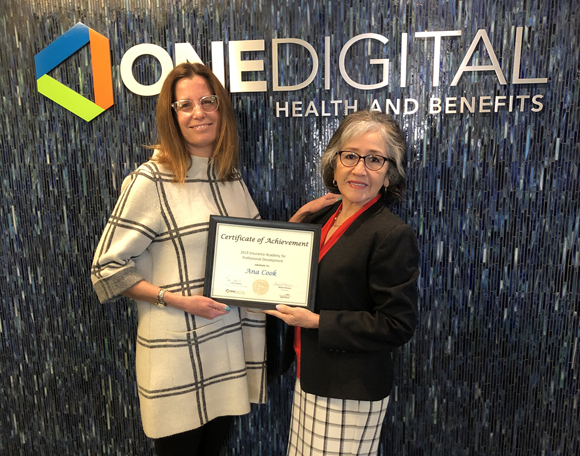

Read more →Team Member Spotlight

Congratulations to Ana Cook for completing the Insurance Academy Series with OneDigital! Ana wears many hats…

Read more →How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives…

Read more →