The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

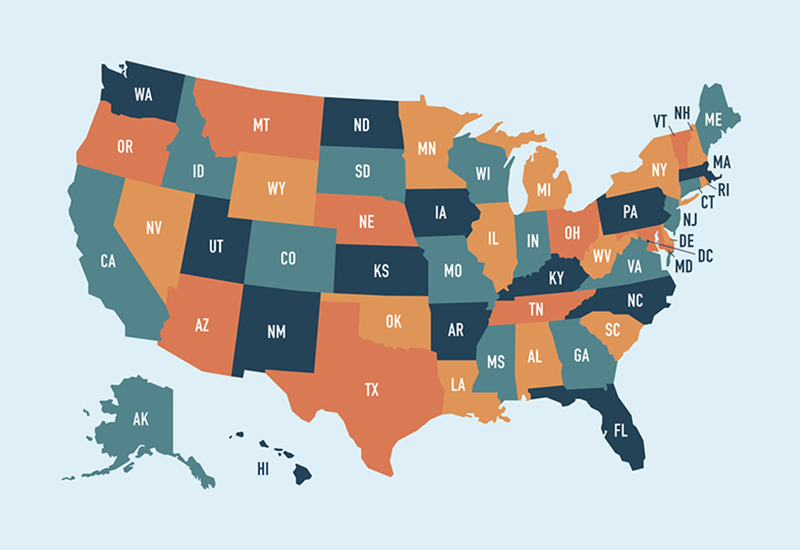

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...Future-Forward Manufacturing

Many manufacturers are feeling the impact of the current crisis. But companies that are ready to retool and ...

Read this insight By the Numbers: The Key Adjustments for 2021

What will 2021 bring us? After a year of turmoil and surprises, no one has a ...

Read this insight Restructuring Debt as a Business Strategy

Many businesses are facing the financial effects of the Covid-19 pandemic. The loss of clients and ...

Read this insight Hobby or Business: The IRS Takes a Stand

From a tax perspective, the distinction between hobbies and businesses is important because businesses can deduct ...

Read this insight Year-End Tax Planning for Businesses

Many businesses remain steeped in financial, operational, and HR challenges related to the COVID-19 crisis, but ...

Read this insight Year-End Tax Planning for Individuals

We recognize the impact this unimaginable year has had on all of us. There have been ...

Read this insight Retirement Plan Options for Self-Employed Business Owners

Owning your own business gives you a great deal of freedom to make your own choices. ...

Read this insight 5 New Updates on Economic Impact Payments

New information continues to unfold as Congress provides clarity on several aspects of the economic impact ...

Read this insight How To Use a CPA as an Expert Witness

A CPA may be called upon as an expert witness to render a professional opinion, whether ...

Read this insight 10 Ways to Improve Your Cash Flow

Cash flow is king. It is the lifeblood of any business. Often referred to as “working ...

Read this insight Tips for a Quicker End to Your Mortgage

If you're serious about paying off your mortgage quickly, realize that every dollar you add to ...

Read this insight Can I Claim a Home Office Deduction During COVID?

Many of us have rearranged, redecorated, or reimagined our homes to convert them into office spaces ...

Read this insight