The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

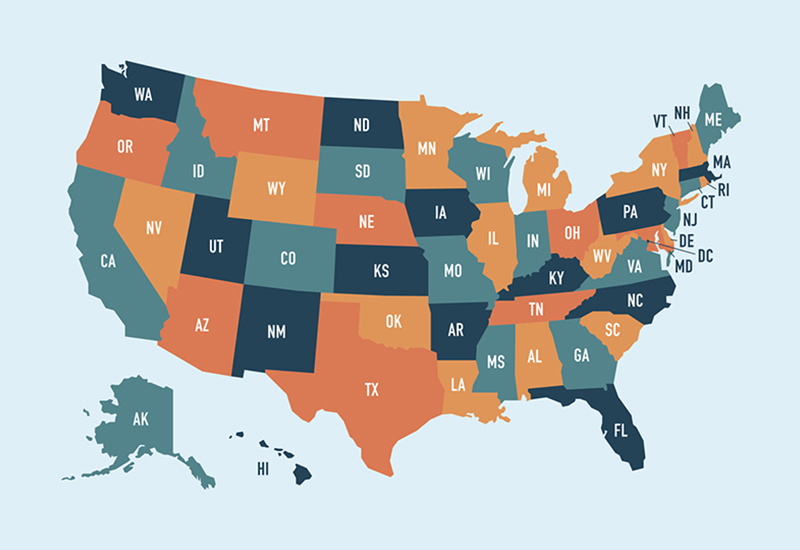

Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

New Benefit Plan Auditing Standards Effective Date Extended

Another pandemic-powered delay is pushing the effective date back for new standards related to audits of ...

Read this insight To Port or Not to Port: Is Filing for Portability Right for You?

The option of portability when planning your estate could make a substantial difference come tax time, ...

Read this insight Top 10 Ways Accounting Services Can Grow Your Business

Any successful business will tell you that having excellent accounting is the secret ingredient to growing ...

Read this insight Update on Coronavirus Relief Programs

New Tax Relief & Grants will Support Businesses Impacted by COVID-19 As businesses and taxpayers continue to feel ...

Read this insight IRS Introduces the New Form 1099-NEC

The IRS has introduced a new Form 1099-NEC, Nonemployee Compensation. It's a sibling to Form 1099-MISC ...

Read this insight When Does a Gift Require a Gift Tax Return, and Gift Tax?

With lifetime gift and estate tax exemptions at an all-time high in 2020, not as many ...

Read this insight Future-Forward Manufacturing

Many manufacturers are feeling the impact of the current crisis. But companies that are ready to retool and ...

Read this insight By the Numbers: The Key Adjustments for 2021

What will 2021 bring us? After a year of turmoil and surprises, no one has a ...

Read this insight Restructuring Debt as a Business Strategy

Many businesses are facing the financial effects of the Covid-19 pandemic. The loss of clients and ...

Read this insight Hobby or Business: The IRS Takes a Stand

From a tax perspective, the distinction between hobbies and businesses is important because businesses can deduct ...

Read this insight Year-End Tax Planning for Businesses

Many businesses remain steeped in financial, operational, and HR challenges related to the COVID-19 crisis, but ...

Read this insight Year-End Tax Planning for Individuals

We recognize the impact this unimaginable year has had on all of us. There have been ...

Read this insight