The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

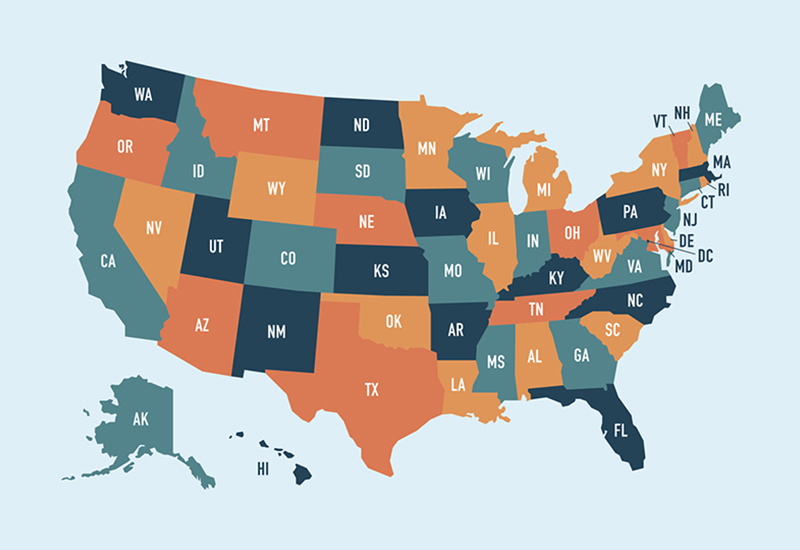

Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Year-End Tax Planning for Individuals

As we near the end of another turbulent year, it’s time to discuss the steps you ...

Read this insight Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another ...

Read this insight On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses ...

Read this insight What To Know About the New Lease Accounting Standard

Every day that passes marks less time for private companies to get ready for ASC 842, ...

Read this insight Credit for Other Dependents: A CTC Alternative

The IRS is reminding families about the Credit for Other Dependents, a tax credit available to taxpayers for ...

Read this insight Document Management and Recordkeeping for Nonprofits

If you work for a nonprofit that's funded by grants or donations, you need to keep ...

Read this insight Estate Planning for High-Net-Worth Individuals

President Biden's proposed infrastructure plan does not explicitly raise estate taxes. Instead, it ends the step-up ...

Read this insight The Future of Global Minimum Tax and Multinational Corporations

The "race to the bottom" of international tax rates may soon come to an end. The ...

Read this insight How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic. ...

Read this insight Child Tax Credit Advances Start July 15

On July 15, 2021, the IRS will start sending monthly child tax credit payments to qualifying ...

Read this insight Are You Ready To Retire Early?

Maybe your job, even your entire sector, has disappeared in 2020's economic turmoil. Or perhaps you ...

Read this insight Accounting Tips to Benefit Your E-Commerce Business

E-commerce marketplaces popped up in the early 1990s and have been on the rise ever since. ...

Read this insight