The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

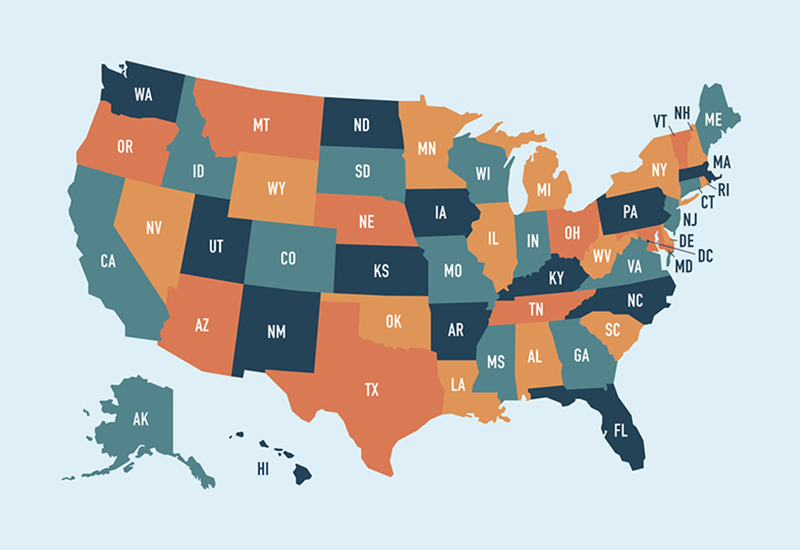

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...2022 Year-End Tax Planning for Individuals

While 2022 started out with some uncertainty about potential tax law changes, very few of the ...

Read this insight 2022 Year-End Tax Planning for Businesses

It’s the time of year when we’re immersing ourselves in fall sports, thinking about the holiday ...

Read this insight What Is an S-Corp Election?

Download our Whitepaper Click below to view our in-depth whitepaper. Contact Us We are always interested ...

Read this insight Accounting Today Names BPW a ‘2022 Best Midsized Firm to Work For’ 10 Years Running

SANTA BARBARA, CA – September 15, 2022 – Bartlett, Pringle, & Wolf, LLP (BPW) was recently ...

Read this insight The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains ...

Read this insight Crystal A. Knepler Named Partner

SANTA BARBARA, CA – September 1, 2022 – Bartlett, Pringle & Wolf, LLP (BPW), a leading ...

Read this insight IRS Grants Failure to File Penalty Relief for 2019 and 2020 Returns

Executive Summary The IRS released Notice 2022-36 providing relief for certain taxpayers from certain failure to ...

Read this insight IRS Extends Time to Make Portability Election

Portability is often an effective, go-to estate planning strategy that could make a considerable difference for ...

Read this insight Gifts-in-Kind: New Reporting Requirements for Nonprofits

Nonprofits that receive contributions of nonfinancial assets are subject to new financial reporting rules. Because of ...

Read this insight The Price of War: Risks Around the Inflation Outlook

While we expect the annual inflation rate to peak this quarter as comparisons to the lower ...

Read this insight A Fresh Look at Retirement Withdrawal Rules

Strict rules govern the timing of retirement account withdrawals. These rules may change in the near ...

Read this insight BPW Named Among Accounting Today’s 2022 Top Regional Leaders

Bartlett, Pringle & Wolf, LLP (BPW) is excited to share that the firm was recently named ...

Read this insight