The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

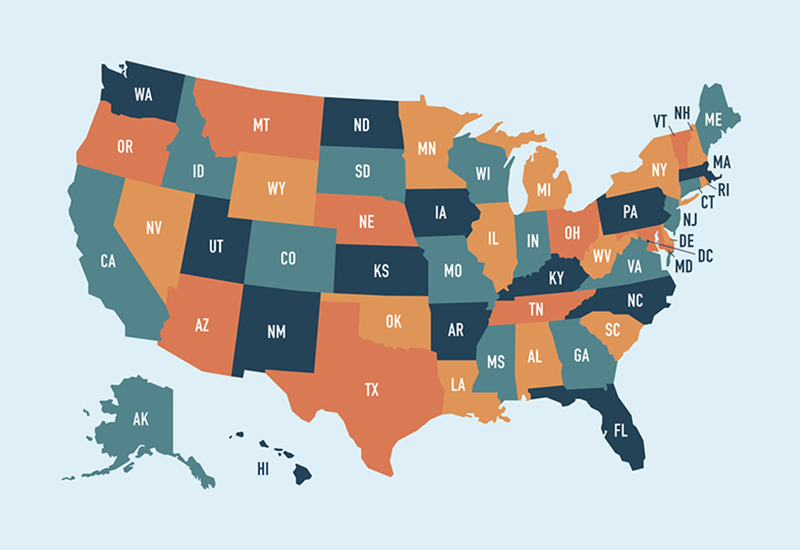

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...Obtaining the Medical Care You Deserve

What happens when your insurance company rejects the procedures you need? There are options available to ...

Read this insight The Power of Integration

Myth: Accounting systems are for the accountants and CRM is for the sales people. Isn't that ...

Read this insight 2011 Year-End Tax Planning for Businesses

While some businesses may still be sorting through all the legislative changes from 2010, it is ...

Read this insight Generating Interest with Intrafamily Loans

Lending money to family members may be personal, but it pays to treat loans like business. ...

Read this insight Bartlett, Pringle & Wolf, LLP Named One of the 2010 Best Accounting Firms to Work for

Bartlett, Pringle & Wolf, LLP (BPW) was named as one of the 2010 Best Accounting Firms ...

Read this insight - « Previous

- 1

- …

- 26

- 27

- 28