The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

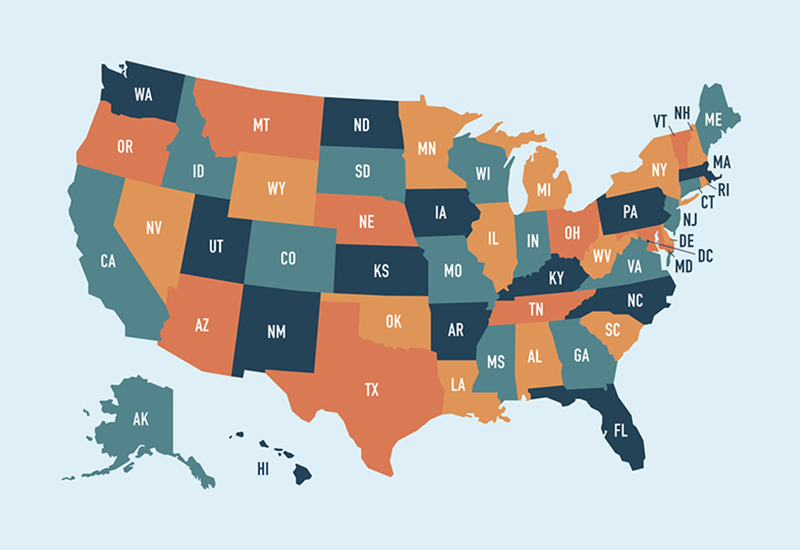

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...IRS Debuts Final Repair Regs

To expense or capitalize? That is the question companies face when they acquire, produce or improve ...

Read this insight Ellyn Cole Named One of the 40 Under 40

Congratulations to Ellyn Cole, who was recently named one of the 40 Under 40 by the Pacific ...

Read this insight IRS Changes How Tips & Service Charges are Handled

As you may recall from a previous article, the new IRS rule on classifying tips and ...

Read this insight John Britton Honored by Rotary Club of Santa Barbara North

Santa Barbara, CA – BPW Partner, John Britton, was recently honored with the Vocational Service Award ...

Read this insight 2013 Year-End Tax Planning for Businesses

I hope that you had the opportunity to read Elizabeth's blog article, where she discussed tax ...

Read this insight 2013 Year-End Tax Planning for Individuals

As we near the end of 2013, now is an excellent time of year to review ...

Read this insight Points to Remember When Planning Your Estate

It is on your list of things to do, but something always comes up. Estate planning ...

Read this insight Proposed Changes to U.S. GAAP Could Reduce Burden on Private Companies

The Private Company Council (PCC) was established last year by the Financial Accounting Foundation (FAF) to ...

Read this insight BPW Donates to Develop Africa

BPW turned a printer mistake to good use by donating over 1,500 gold pens to school ...

Read this insight The Role of a Forensic Accountant in Today’s Business Climate

With the ever-changing business climate, we are seeing an evolving role for the forensic accountant. Going ...

Read this insight California Franchise Tax Board Strikes Again

One of the few benefits that entrepreneurs and investors were able to take advantage of in ...

Read this insight Danna McGrew Named one of the Top Women in Business

Congratulations to BPW Partner Danna McGrew, who was named one of the Top 50 Women in ...

Read this insight