The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

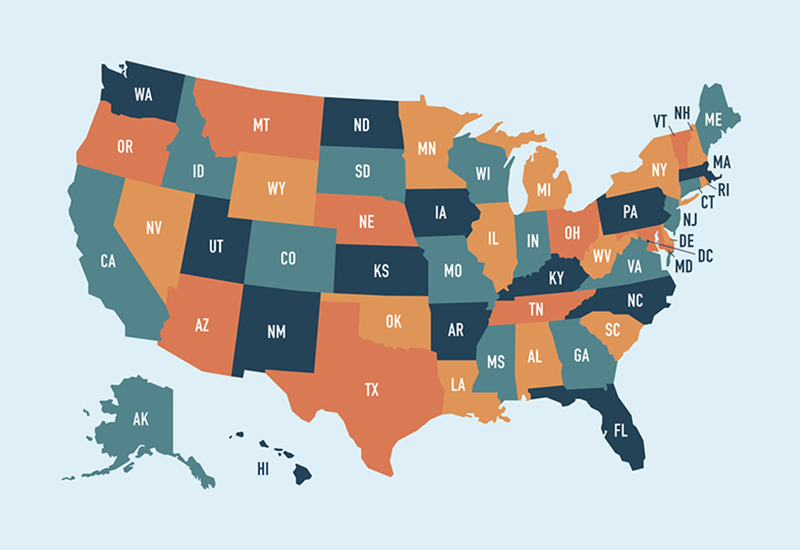

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...2014 Year-End Tax Planning for Individuals

It's hard to believe that we are getting towards the end of another year, but with ...

Read this insight Bonnie Zappacosta Receives 40 Under 40 Award

Congratulations to BPW's Marketing Manager, Bonnie Zappacosta, who was recently named one of the 2014 40 ...

Read this insight The Tax Reform Act of 2014’s Effect on Nonprofits

In early 2014, Dave Camp, U.S. Congressman and Chairman of the Ways and Means Committee, unveiled ...

Read this insight Phone Scams Continue

It is important to us at BPW to keep our clients and community apprised of not only important industry ...

Read this insight CA Partial Sales and Use Tax Exemption

As a way to encourage economic growth in California, a new tax law recently went into ...

Read this insight Targeted Partnership Allocations on the Rise

When working with partnership formation agreements for traditional partnerships and Limited Liability Companies, it has become ...

Read this insight The IC-DISC: How Your Foreign Sales Can Save You Tax

If your business exports goods that are made or grown in the United States or performs ...

Read this insight Regulations Released for Estate and Trust Deductions

The IRS has issued final regulations as to which costs incurred by non-grantor trusts and estates ...

Read this insight Converged Standard on Revenue Recognition Released by FASB and IASB

After many years of collaboration, the Financial Accounting Standards Board (FASB) and the International Accounting Standards ...

Read this insight A Major Change in the Rules of IRA Rollovers

With a recent ruling by the United States Tax Court (the Court), there is now a ...

Read this insight The Magic of AP Automation

Somewhere in an office not so far from here, there is a company that gets all their ...

Read this insight Form 990: How a Nonprofit Can Survive an IRS Audit

"Death, taxes and childbirth! There's never any convenient time for any of them." (Margaret Mitchell, Gone ...

Read this insight

.jpg)