The Inflation Reduction Act and What It Means for You

The Inflation Reduction Act (the Act) was recently signed into law on Aug. 16 and contains…

Read this Insight...Important Changes to California’s Elective Pass-Through Entity Tax

California recently revised its SALT cap workaround to be more appealing for qualifying owners of S…

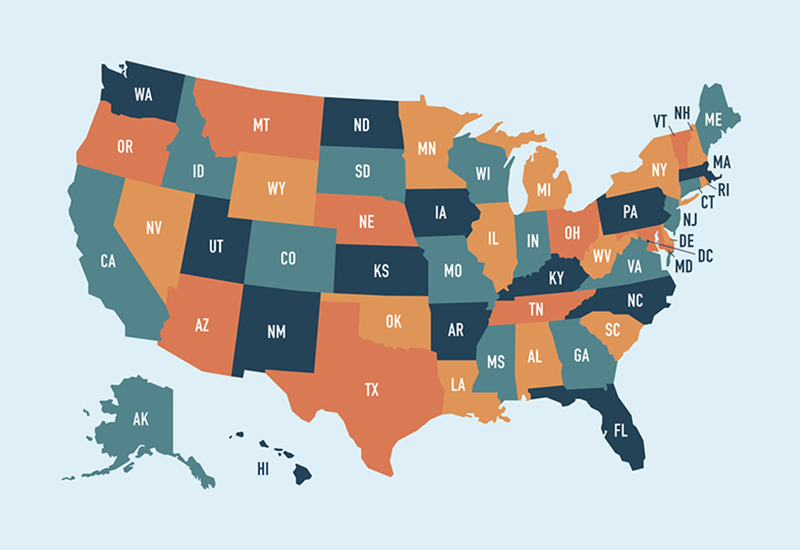

Read this Insight...Employees in Other States? Here are the Top Tax Implications to Consider

Return-to-office plans remain in a state of limbo as some employers find that a remote work…

Read this Insight...Year-End Tax Planning for Businesses

2021 brought a wave of new tax changes for businesses, and 2022 could bring yet another…

Read this Insight...On Your Mark, Small Businesses: Get Set to Reserve the 2021 Main Street Hiring Credit

The Main Street Hiring Credit has been reenacted for 2021, bringing financial relief to small businesses…

Read this Insight...How to Claim the Employee Retention Tax Credit

Congress created an employee retention tax credit to retain employees on their payroll during the pandemic.…

Read this Insight...Not-for-Profits Now Benefit from GAAP Alternatives

The Financial Accounting Standards Board (FASB) recently announced that it will now extend two of its ...

Read this insight Retirement Withdrawal Strategies

Are you retired or thinking about it? That probably means you are preparing to transition from ...

Read this insight Cloud-Based Versus On-Premise Software

Last month we announced our newest partnership with Acumatica to offer cloud-based ERP software services. But ...

Read this insight Lingering Uncertainties Post Tax Season

Now that April 15 has come and gone, have all of our tax reform questions been ...

Read this insight Team Member Spotlight

Congratulations to BPW Partner Tracey Solomon and BPW Supervisor Tiffany Ann Goodall on their recent awards ...

Read this insight BPW Named Best Place to Work

We are proud to have earned the recognition of Central Coast Best Places to Work by ...

Read this insight IRS Audits Decline for Millionaires and Large Businesses

IRS audits of wealthy taxpayers and big business are on the downtick, reaching record lows in ...

Read this insight DOL Revisits Overtime Rule in Proposal

On March 7, the Department of Labor (DOL) released a proposed rule that would raise the ...

Read this insight IRS Released Safe Harbor Guidance for Vehicle Deductions

The IRS recently released a safe harbor method that harmonizes 100% bonus depreciation with the annual ...

Read this insight Tax-Savvy Retirement Planning

With over 70 million baby boomers in the United States, how many are celebrating their 65th ...

Read this insight What is Acumatica?

Nearly everyone has their head in the cloud these days—and for a good reason. Cloud-based ERP ...

Read this insight IRS Issued Final Guidance on 199A Deduction for Pass-Through Entities

Forecasting, Finance, Calculator, Budget, Home Finances, Coffee, In a highly-anticipated release, the IRS provided a final ...

Read this insight