CA Implements Wayfair Sales Tax Decision

Another important deadline will make an entrance in April next year. Effective April 1, 2019, the…

Read this Insight...Court Overturns Physical Presence Standard in Sales Tax Decision

With the surge of online shopping dominating the retail space, a recent U.S. Supreme Court 5-4…

Read this Insight...Update: Tax Reform Moving Through Congress

In last month’s newsletter, we gave a brief overview of the Trump administration’s tax reform proposal,…

Read this Insight...Safe Harbor Benefits Restaurant and Retail Industry

There has been a lot of discussion surrounding Tangible Property Regulations—from implementing the new regulations to…

Read this Insight...Tax Deadline Reminder: FBARs Due by June 30

The deadline is fast approaching for certain taxpayers to report accounts they hold in foreign banks…

Read this Insight...Reduced Restrictions on In-Plan Roth Rollovers

Among the changes and extensions in the recently enacted American Taxpayer Relief Act of 2012 (“Act”),…

Read this Insight...Three Strategies That Add Flexibility to Your Estate Plan

In recent years, estate planning has been complicated by uncertainty over the future of the federal…

Read this Insight...The CARES Act: An Overview for Individuals

The CARES Act provides some big wins for individual taxpayers who are in need of an ...

Read this insight The CARES Act: An Overview for Businesses

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on Friday, March ...

Read this insight Income Tax Relief in Response to COVID-19 Outbreak

On March 20, 2020, the IRS extended the federal tax filing deadline to July 15, 2020, ...

Read this insight Reporting Requirements for Video Game Currency

Amid school and business closures, some gamers may be increasing their screen time and raking in ...

Read this insight IRS Released Guidance on Meal and Entertainment Expense Deductions

In recently-proposed regulations, the IRS states that, in general, taxpayers can deduct 50% of the ordinary food ...

Read this insight Is a Donor-Advised Fund Right for You?

Donor-advised funds (DAFs) have grown in popularity over the past decade. According to the National Philanthropic Trust ...

Read this insight The SECURE Act: Key Takeaways and Strategies to Consider

Over the past few years, we have seen some of the greatest shifts in tax legislation. ...

Read this insight Tax Tips for Law Firms

Whether you're a partner or an associate in a law firm, the IRS has rules that ...

Read this insight Tax Deductions from Land Donations Under Scrutiny

The IRS announced that they will be keeping a watchful eye on certain land donation deals ...

Read this insight IRS Establishes No Clawback Rule on Gifts and Estates

‘Tis the season for giving! In a recent announcement, the IRS presented the highly-anticipated final regulations ...

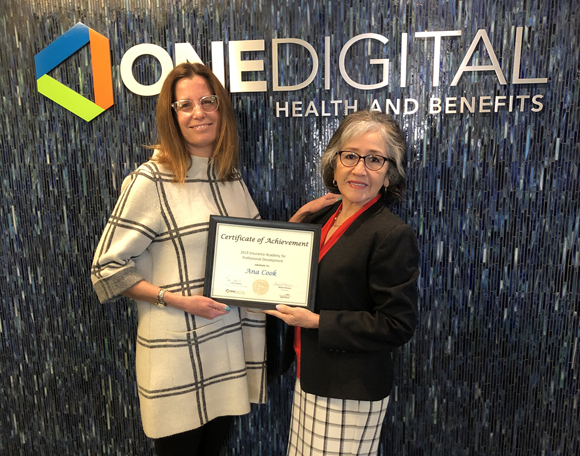

Read this insight Team Member Spotlight

Congratulations to Ana Cook for completing the Insurance Academy Series with OneDigital! Ana wears many hats ...

Read this insight How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives ...

Read this insight