IRS Extends Time to Make Portability Election

Portability is often an effective, go-to estate planning strategy that could make a considerable difference for…

Read this Insight...May 7 Deadline for Big Businesses

The Treasury Department is granting safe harbor to large and public companies that voluntarily return stimulus…

Read this Insight...Is a Donor-Advised Fund Right for You?

Donor-advised funds (DAFs) have grown in popularity over the past decade. According to the National Philanthropic Trust…

Read this Insight...Uncertain Future for CA Estate Tax

California is currently among 30 states that do not impose a state estate tax. State legislature,…

Read this Insight...Generating Interest with Intrafamily Loans

Lending money to family members may be personal, but it pays to treat loans like business.…

Read this Insight...The CARES Act: An Overview for Individuals

The CARES Act provides some big wins for individual taxpayers who are in need of an ...

Read this insight The CARES Act: An Overview for Businesses

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on Friday, March ...

Read this insight Income Tax Relief in Response to COVID-19 Outbreak

On March 20, 2020, the IRS extended the federal tax filing deadline to July 15, 2020, ...

Read this insight Reporting Requirements for Video Game Currency

Amid school and business closures, some gamers may be increasing their screen time and raking in ...

Read this insight IRS Released Guidance on Meal and Entertainment Expense Deductions

In recently-proposed regulations, the IRS states that, in general, taxpayers can deduct 50% of the ordinary food ...

Read this insight Is a Donor-Advised Fund Right for You?

Donor-advised funds (DAFs) have grown in popularity over the past decade. According to the National Philanthropic Trust ...

Read this insight The SECURE Act: Key Takeaways and Strategies to Consider

Over the past few years, we have seen some of the greatest shifts in tax legislation. ...

Read this insight Tax Tips for Law Firms

Whether you're a partner or an associate in a law firm, the IRS has rules that ...

Read this insight Tax Deductions from Land Donations Under Scrutiny

The IRS announced that they will be keeping a watchful eye on certain land donation deals ...

Read this insight IRS Establishes No Clawback Rule on Gifts and Estates

‘Tis the season for giving! In a recent announcement, the IRS presented the highly-anticipated final regulations ...

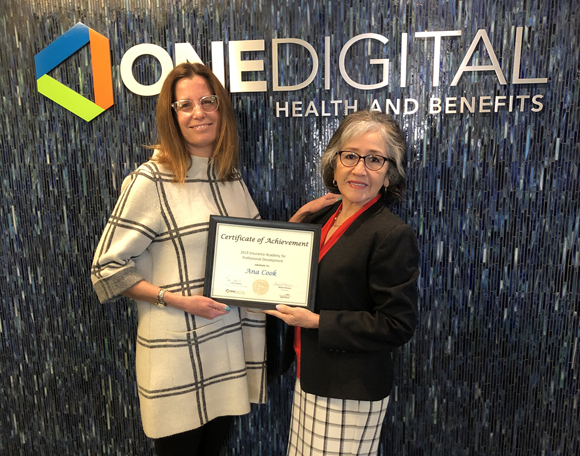

Read this insight Team Member Spotlight

Congratulations to Ana Cook for completing the Insurance Academy Series with OneDigital! Ana wears many hats ...

Read this insight How to Leave Your Digital Legacy

As we continue to expand our digital footprint, it is important to incorporate our digital lives ...

Read this insight